/ Kyndryl and Twimbit reveal APAC banks' remarkable progress in purpose-driven growth, achieving an impressive 9% aggregate revenue growth

Kyndryl and Twimbit reveal APAC banks' remarkable progress in purpose-driven growth, achieving an impressive 9% aggregate revenue growth

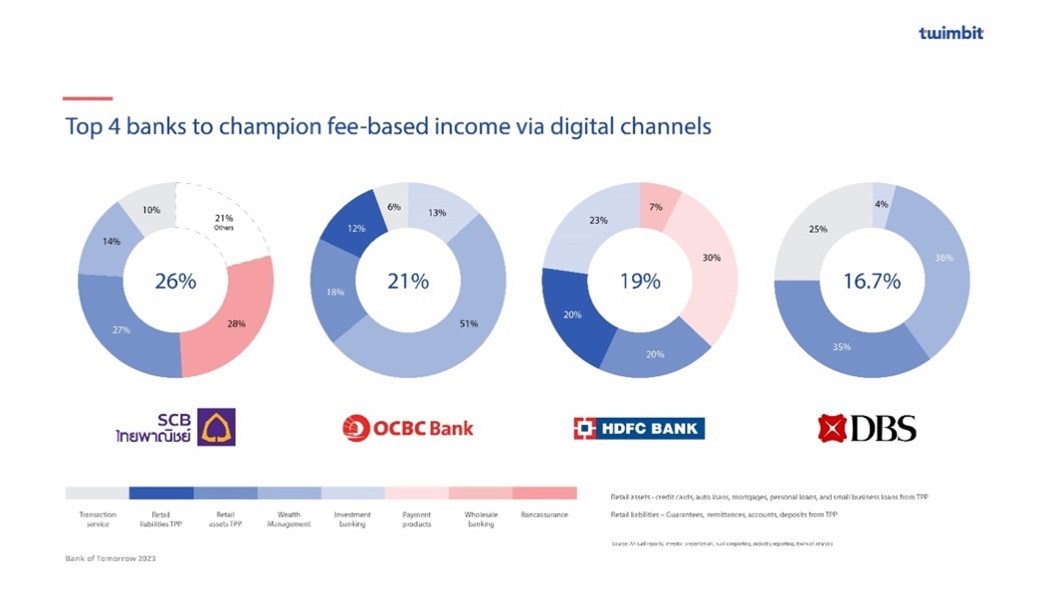

Within the top 44 banks across the region, fee-based income accounts for an average of 13.66% of revenues

SINGAPORE — Kyndryl (NYSE: KD), the world’s largest IT infrastructure services provider, today announced the launch of the Bank of Tomorrow 2023 report in collaboration with research and advisory firm Twimbit. The report offers a thorough assessment of Asia Pacific (APAC) banks and outlines the projected 2023 outlook, tracking their advancements across five purpose pillars — Shareholders, Employees, Partners and Suppliers, ESG, and Customers.

Centred around Twimbit’s Purpose Index, which helps APAC’s leading banking and financial institutions migrate to the future desired state of being purpose-driven organisations, a couple of key trends emerged. Among the 44 top banks in APAC, a remarkable 16 new entrants were found to be making significant strides in both purpose-driven initiatives and growth. Additionally, spanning four purpose pillars — Customer experience, employee experience, supplier satisfaction, and ESG impact — DBS Bank retained its leading position. The bank not only commands the highest purpose score but also boasts above-average profitability. In close pursuit, Siam Commercial Bank (SCB) secured the second-highest purpose score while maintaining a commendable level of profitability.

Chinese banks remained the most prominent, with the highest revenue size and above-average profitability whilst banks in India were seen to enjoy higher growth rates than many of their peers in other countries. Highlighted in Exhibit 1 are some of the key highlights.

Exhibit 1: A benchmark of the 44 banks according to the Twimbit Purpose Index

Source: Twimbit

“These insights are poised to exert substantial influence on the strategies of businesses and financial institutions, shaping their trajectory towards innovation and expansion. In the case of SCB’s strong performance, credit is largely attributed to their proactive endeavours in bolstering fee-based incomes,” said Manoj Menon, CEO at Twimbit. “We believe fee-based income will become a key growth driver for banks, enabling the generation of alternative revenue streams to drive profitability.”

Exhibit 2: Top 4 Banks to champion fee-based income via digital channels

Source: Twimbit

The importance of fee-based income in driving revenues

In APAC, banks allocated an average of 2.96 percent of their revenues toward information and communications technology (ICT) while the recommended benchmark should hover around 10 percent of revenues.

An example of such divergence is the Bank of Philippine Islands (BPI), which recently announced a significant 50 percent surge in IT spending, propelling its status as a digital frontrunner. Additionally, the National Australia Bank (NAB) stands out as a paragon, showcasing a growth of 16 percent in ICT spending year-on-year.

This increase in investment will drive digital transformation and boost fee-based income growth. Currently, fee-based income is at an average of 14 percent contribution to total revenues, with expectations that the four leading banks will increase their total contribution to 35 percent of revenues by 2030.

"Kyndryl is dedicated to designing, building, managing, and modernising the mission-critical technology systems that the world depends on everyday. We are proud to unveil the Bank of Tomorrow report in partnership with Twimbit, which will significantly impact how businesses and financial institutions will drive innovation and growth moving forward. This industry-wide initiative is aimed to drive invisible banking, achieve a ‘Carbon Neutral 2030’, champion sustainability and promote employee well-being.,” said Susan Follis, Managing Director of ASEAN at Kyndryl.

A purpose-driven future pressures banks to reassess their growth journeys

The report also highlighted that the increasing emphasis on adopting digital-first strategies has gained substantial traction, especially in the advancement of the four purpose pillars. This surge in digital channels has marked a transformative shift within the banking sector.

Prominent aspects include DBS's sustained leadership in CX banking, evident through the accomplishments of DBS Rapid, DBS BetterWorld, and DBS PayLah. SCB’s efforts to harness state-of-the-art technology to propel sustainable financial practices and ESG initiatives, as demonstrated through applications and initiatives like Robinhood and SCB SME Academy. National Australia Bank’s (NAB) digitalised supply chain supporting invoice automation and online catalogues and BPI scoring 90 percent on employee engagement for implementing comprehensive training programs that significantly enhance EX.

"The financial world is undergoing a tectonic shift fuelled by fintech innovation, new technologies, volatile markets, digital finance, and rising cyber threats. In this transformative era, banks must be empowered to navigate change and unlock the true potential of data and AI to improve products and services for their customers. Kyndryl stands at the forefront of this change and is ready to steer businesses towards data-driven innovation and customer-centricity for banking success,” said Susan Follis.

Read the full report “The Bank of Tomorrow 2023: A Benchmark of the leading banks in APAC” for more information.