/ Global telecom vendors achieved an aggregate revenue growth rate of 5.4 percent in Q2 2023

Global telecom vendors achieved an aggregate revenue growth rate of 5.4 percent in Q2 2023

Cisco achieves impressive revenue growth, while ZTE face headwinds due to economic uncertainties

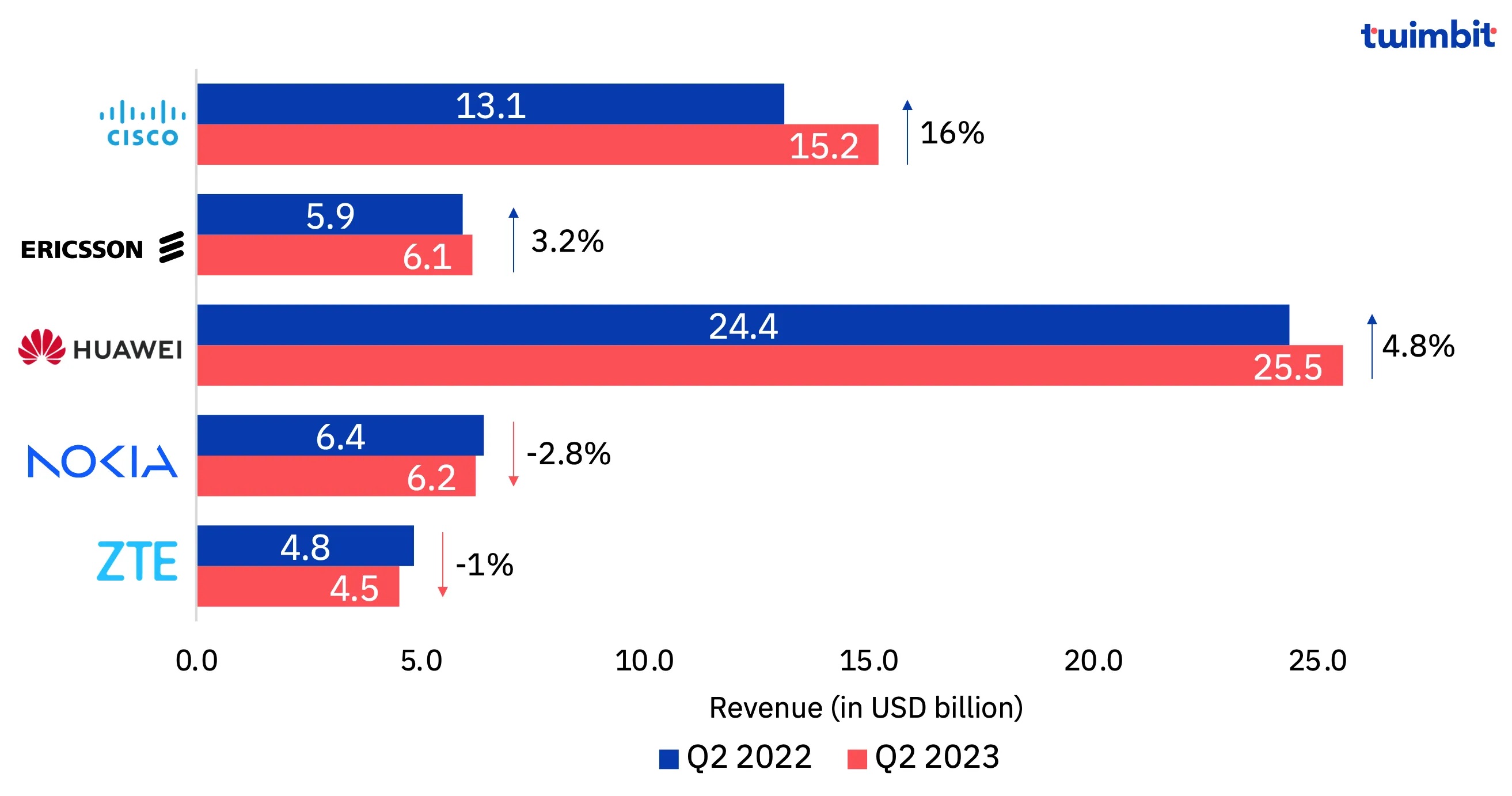

The revenue performance for each vendor is as follows:

Exhibit 1: Revenue trends YoY basis, Q2 2023

Source: Company reports and filings, Twimbit analysis

Cisco leads the chart with excellent performance across all revenue streams, increasing overall revenue growth by 16 percent, totalling USD 15.2 billion. This can be attributed to 3 key factors – product revenue, service revenue and a substantial growth rate of 28.2 percent in its carrier network business. While the enterprise business is a current focus for other telecom vendors, Cisco’s carrier network business has grown significantly due to the success of its Secure, Agile Networks portfolio.

On the other hand, ZTE faced several challenges in Q2 2023 when ensuring peak performance across all revenue streams. This led to an overall decrease in revenue by 1% percent YoY, reaching USD 4.5 billion in the same period. The factors owing to its decline primarily stemmed from its enterprise and consumer business, which reduced by 12.5 percent and 2.5 percent, respectively.

Innovation sustainability and competitive advantages pressure vendors to think differently

With an increased commitment to accelerate innovation and maintain a competitive edge, R&D investment has recorded an overall increase, with telecom vendors aiming to be more digital-centric.

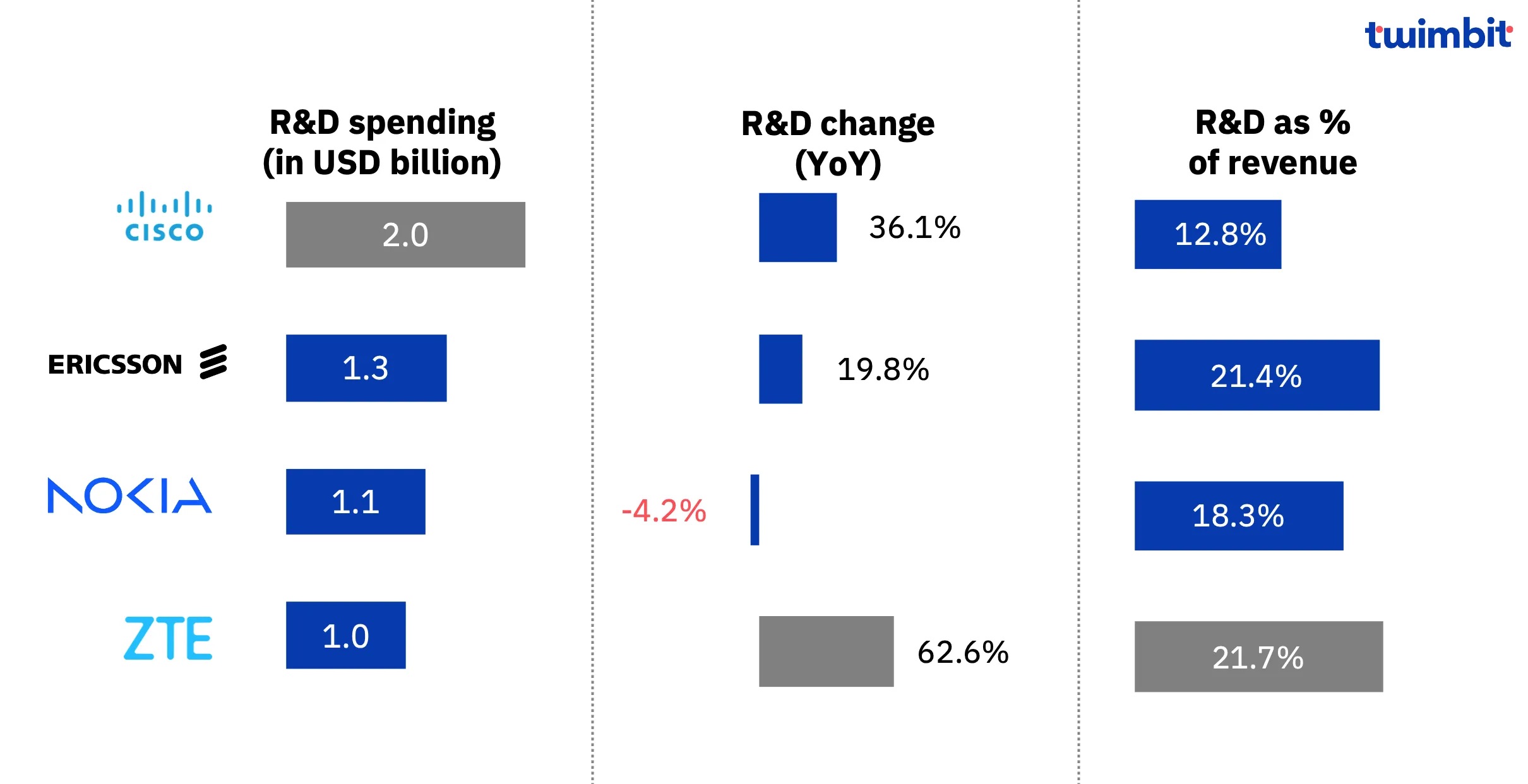

The R&D performance for each vendor is as follows:

Exhibit 2: R&D performance of vendors, Q2 2023

Source: Company reports and filings, Twimbit analysis

ZTE set the gold standard in R&D investments during Q2 2023, increasing investments by 62.6 YoY, totalling USD 1 billion. This can be attributed to its efforts in increasing the computing power for its infrastructure products and solutions. These include reinforcing the capabilities of their Data Technology, Information Technology, and Communications Technology (DICT).

The result – substantially enhanced competitiveness across all the business sectors of ZTE.

Following closely is Cisco, recording a significant 36.1 YoY increase in R&D spending, totalling USD 2.0 billion in Q2 2023. This expansion was a meticulous decision by the company to increase its investment significantly across its international sectors, specifically India, its 2nd largest R&D centre.

“With significant opportunities to become more digital, such as the rollout of 5G, changing regional dynamics and newfound strategic collaborations, telecom vendors have a plethora of options moving forward in 2023.” – Siddanth Ranjan (Research Analyst, Twimbit)

Twimbit clients can read more in the “Global Telecom Vendors Update Q2 2023”